Introduction

The growth and sustainability of the business revolve around finances and its management. For this, businesses use the Account receivables management (ARM) process. Currently, the financial health, recovery rates, and payment periods of the businesses are optimized through the ARM process.

This blog explains the meaning of ARM. It also explores the most innovative ARM strategies that can transform your business finances during the year and promote cash flow.

Understanding Accounts Receivable Management?

ARM refers to managing the outstanding invoices an organization has or managing the money that is owed by the clients to the organization.

Optimizing tracking, recording, and managing the funds owed to any company are the main objectives of ARM. This leads to promoting healthy fund flow, eliminating the chances of bad debts, and promoting financial stability.

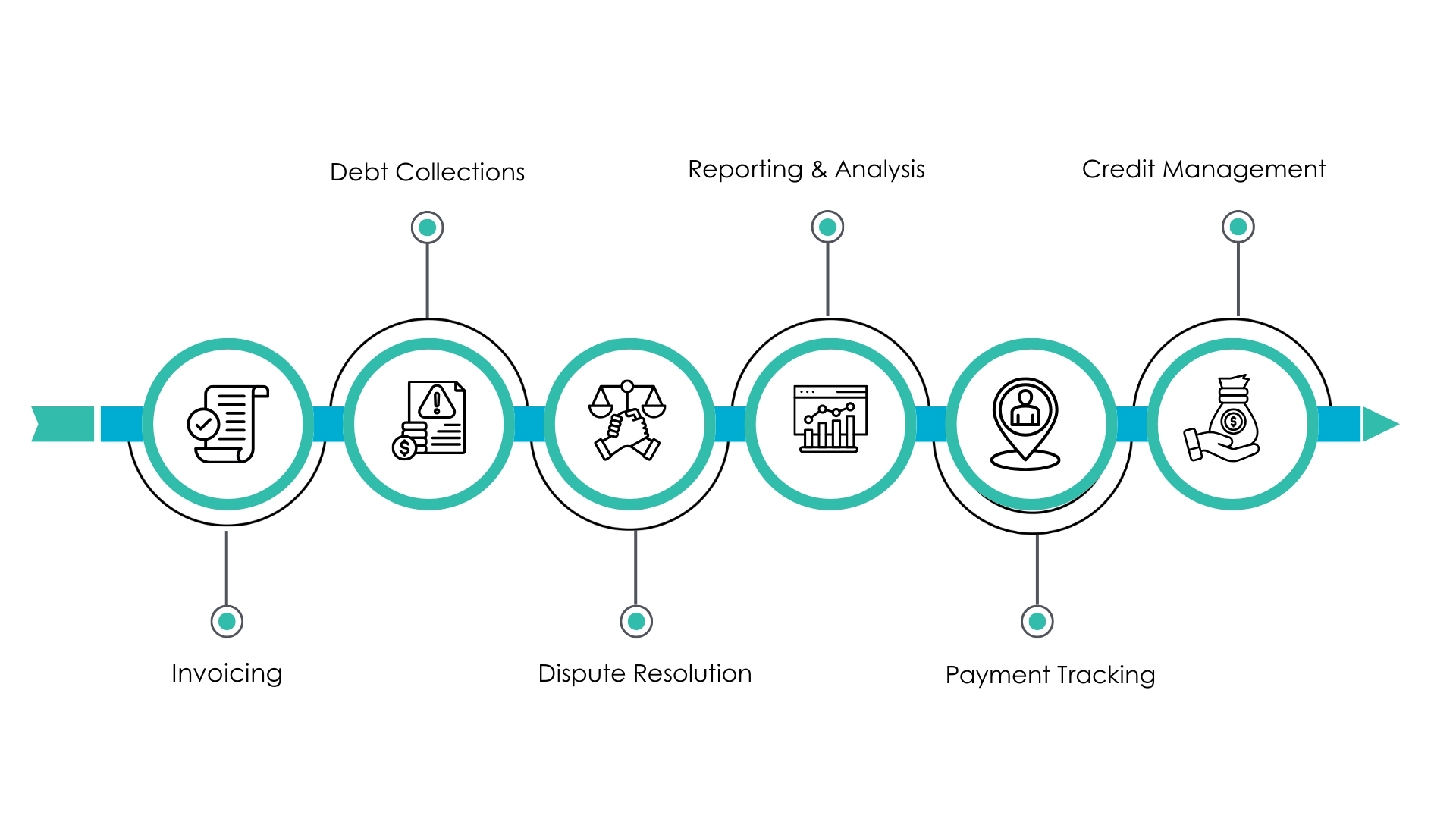

Here’s a deeper look into what accounts receivable management involves:

Innovative Strategies to Manage Account Receivables

With the change in time and technologies, businesses have to adopt the appropriate strategies to grow in the ever-evolving business world. The same applies in managing the accounts receivable.

To manage the account receivables, businesses opt for innovative strategies:

1. Automation and AI

With the adoption of digitalization, businesses have changed the way they operate in the competitive market. The implementation of Automation and AI has transformed the Aaccount Receivables managment services operation. This includes adoption of AI-driven methods and automated systems that assist in invoice handling, recovery cycles, and payment alerts. Moreover, such adoption leads to freeing up the finance department to handle more complex tasks.

“The valuation of accounts receivable/accounts payable automation sectors was USD 13 billion.”

Key Aspects :

- Enhancing the efficiency and reducing inaccuracy in collections and invoices;

- Improving the capability for predicting and mitigating payments past due dates;

- Minimizing the manual tasks for the finance team.

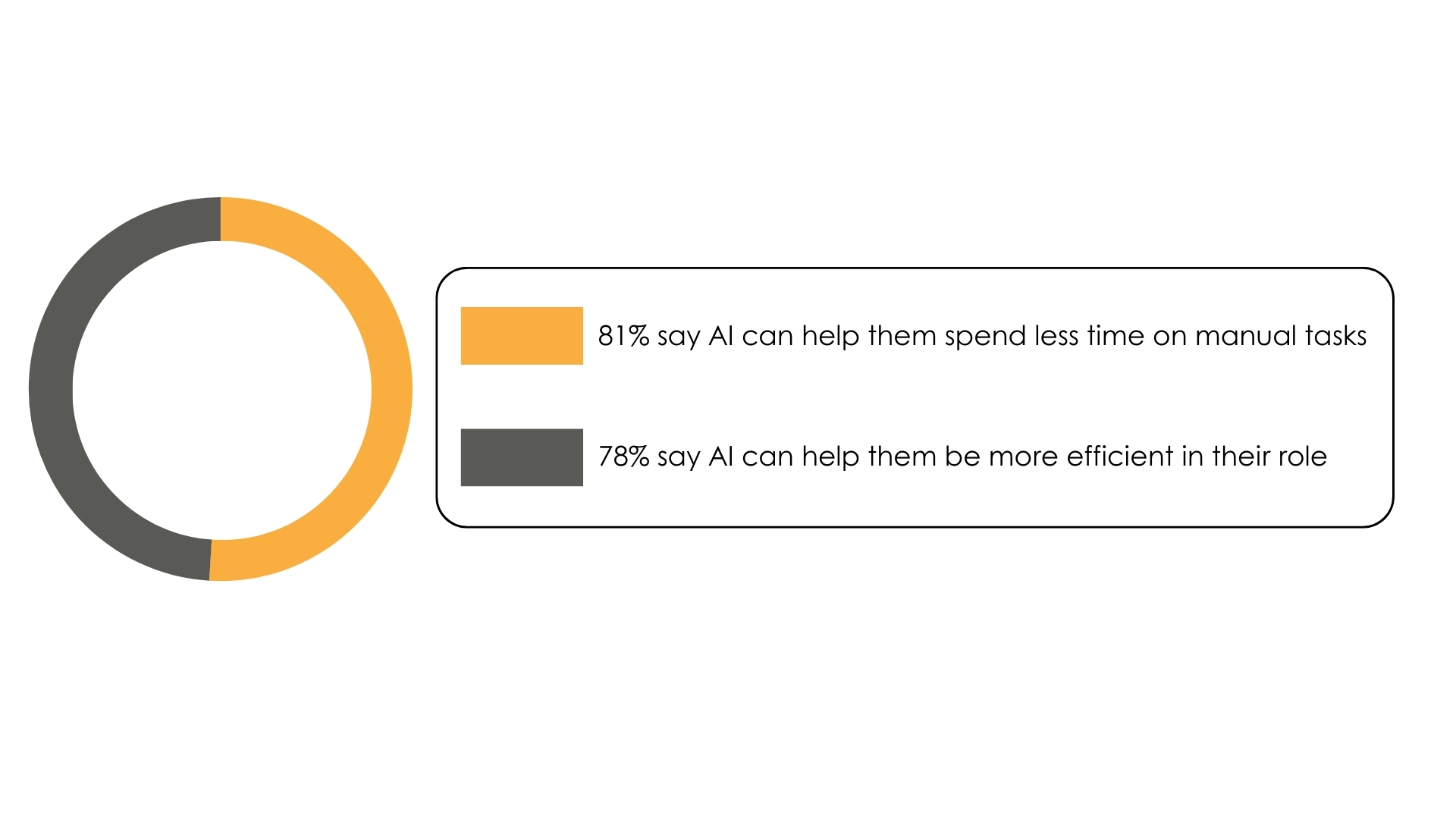

Fun Facts:

- Potential uses of AI are being investigated by 42% of businesses.

- AI investments are being made by 5% of the top organizations.

- The adoption of AI is a major priority for 78% of the leaders to generate corporate importance.

2. B2B Debt Collection Solutions

B2B debt collection focuses on dealing with financial recoveries and maintains fund flow effectively. ARM processes involve handling and streamlining complex B2B transactions. Moreover, businesses are also implementing personalized strategies to recover their outstanding payments.

Key Aspects:

- Handling B2B debt collection professionally;

- Improved B2B recovery rates;

- Sustaining business relationships;

3. Blockchain Technology

Another transformative force in ARM is the implementation of blockchain technology. It secures the transactional process, ultimately enhancing transparency. E-invoicing is supported by blockchain technology that promotes cyber security and speed. Blockchain technology aims to minimize the chances of cyber fraud, enhance its integrity, and ensure smooth international payments.

Key Aspects:

- Improved security and transparency;

- Minimized fraud and inaccuracies;

- Smooth cross-border transactions.

4. Cloud Services

Cloud-based solution is a technology that is being used by almost every company. This technology promotes convenience and flexibility for both, companies as well as customers. Cloud solutions provide convenience to access the platforms from anywhere and anytime. Furthermore, it also provides a real-time update of the account receivables and payment activities.

As per O-Reilley’s report, over 90% of businesses use the cloud in one way or another.

Key Aspects:

- Real-time access to receivables data;

- Enhanced collaboration and communication;

- Scalability to accommodate business growth.

5. Prompt Payment Culture

It is essential for businesses to establish a prompt payment culture within the organization and amongst their customers or B2B clients to manage the account receivables. Moreover, it is beneficial for the businesses to establish such culture and promote effective payment norms, ultimately ensuring quick payment and maintaining financial health.

Key Aspects:

- Improved customer relationships;

- Reduced debt collection efforts;

- Enhanced fund flow and financial debt.

6. Flexible Payment Options

To generate fast payments, it is essential for customers and B2B clients to get flexible options to make payments. Such options include early payment benefits, installment plans, and providing payment options through credit/debit cards, bank transfers, and digital wallets. Moreover, businesses can also provide certain options based on customer’s financial backgrounds. Ultimately, the aim is to minimize uncovered funds, improve early payments, and maintain cash flows.

As per a survey, only 53% of businesses want to accept or accept electronic payment methods instead of manual transactions.

81.2% of the respondents state that the limited payment options have impacted their deal closure.

Key Aspects:

- Enhanced timely payments;

- Improved trust and satisfaction;

- Effective compliance with customer requirements.

7. Customer Interaction

The key to effective customer interactions is establishing successful ARM processes. Implementing omnichannel communication strategies ensures that you can reach customers through their preferred channels, whether it’s email, SMS, or phone calls. Personalizing communication based on customer behavior and preferences can also improve response rates and foster better relationships.

Fun facts:

98% of the customers prefer businesses to communicate effectively.

66%of customers have moved to another company due to bad communication.

Key Aspects:

- Fast recovery rates and payments;

- Enhanced satisfaction and trust;

- Eliminating disputes and misunderstandings.

8. Outsourcing Accounts Receivable Management Services

Outsourcing ARM services allow businesses to focus on their operating activities, along with promoting account receivables. Professional account receivable management service providers bring expertise, advanced technology, and best practices to the table, which can lead to improved collection rates and overall efficiency.

Key Aspects:

- Access to specialized expertise and technology;

- Reduced burden on internal resources;

- Improved efficiency and collection rates.

Bill Gosling Outsourcing is an organization that handles account receivable management operations. It also provides first- and third-party collections, legal debt recovery, and more.

Read More – How professional Repossession notice services can aid in reclaiming assets while ensuring legal compliance.

9. Advanced Analytics Implementation

Businesses are also implementing advanced data analytics to generate effective insights and manage their accounts receivables. This technology helps predict new market trends and payment patterns to understand the recovery process. Moreover, analytics are used to make informed decisions and alter the collection strategies accordingly.

Key Aspects:

- Understanding payment patterns and behavior;

- Categorizing account receivables on risk and payment behavior;

- Managing collections and making informed decisions.

Conclusion

In conclusion, businesses must include Outsourcing Accounts Receivable Management Services into their innovative strategies and comply with the market and customer expectation changes. However, businesses adopt hybrid approaches based on their requirements and maintain their fi nancial health while minimizing unrecovered debts.

Learn more about How FinTech is reshaping finance in the U.S. by downloading this detailed whitepaper.–