Introduction

It is imperative that reliance on outdated methods, like invoicing, be abandoned to maintain smooth cash flow in the fast-changing digital economy. It is like an age-old commercial process with manual bills, awaiting payment, and repeat. Nevertheless, today, a rapid change with advancing technology has led to the beginning of digital solutions for business-to-business (B2B) collections, thus becoming an integral part or even a substitute for conventional billing. These methods are changing the entire picture of monetary management and money collection in business, making it more efficient, secure & flexible.

This article delves into other advanced support services not limited to conventional e-invoicing, from electronic invoicing to the blockchain.

Electronic Invoicing (E-Invoicing)

Through e-invoicing, companies can send and receive electronic invoices, which will help expedite and improve the accuracy of business deals. E-invoice system integration with accounting software eliminates human input of figures in such cases. It accelerates the payment process and smooths the whole financial workflow. E-invoicing has the additional advantage of facilitating the creation of automatically generated bill reminders and follow-ups, leading to a decrease in unpaid bills and enhanced cash flow. Due to this digital transaction feature, everything related to business payment, such as generating, sending, delivering, or handling an invoice, becomes effective, faster, and better.

Payment Portal and Self-Service Options

Payment portals and self-service options are creative methods to approach B2B collection. The best thing about them is that they give you easy ways to make a payment, check your balance, and see how often you receive money. These professional services include the provision of various means of payment, including credit cards and Internet banking, along with other alternatives through which customers will find it easy to liquidate their debt.

Customers can also access their transaction history via payment portals, which minimize disputes so they can solve problems. It cuts down on overhead costs for firms while enhancing customer satisfaction. A payment transaction record on such self-service portals is for the safety of the client’s information.

Subscription and Recurring Billing

Many B2B firms have now adopted subscription-based and recurrent billing models. This model allows companies to install recurring receivables that enable a company not to issue invoices for every sale or purchase transaction. The approach is correct for companies selling SaaS, memberships, or maintenance contracts. It ensures that a business has fixed revenue, which is predictable in the long run, thus reducing anxiety when dealing with cash flow. In addition, it reduces the workload of physical invoicing and debt collection, thereby minimizing the chances of delayed or unpaid bills.

Mobile Payment Solutions

The collection of B2B payments is transforming with mobile payment solutions. The models allow organizations to settle transactions all together. With mobile devices, field sales teams, service technicians, and other staff can use them for accepting payments on-site. It enables faster collection of debt and improves customer convenience. It is possible to pay at any place and time due to the increased availability of mobile phones and applications for smartphones used in business.

Blockchain and Smart Contracts

There is the use of blockchain technology in managing contracts and transactions. B2B payments are safe when making a contractual agreement with the other party on the completion of the delivery according to the conditions pre-set. A smart contract may pay automatically without manual involvement in invoice processing and approval. The primary advantage of this technology is that each transaction is on an unchangeable, decentralized database—the blockchain. It minimizes conflicts and scams and makes it attractive for businesses engaged in B2B transactions at complexity levels.

Artificial Intelligence and Machine Learning

The use of artificial intelligence in improving the B2B collection process is on the rise. Such technologies enable collections teams to develop data-driven collection plans based on analysis of account payment history, customer experience, and macro market trends. As such, using intelligence can predict what will take longer before being paid and target collection efforts depending on that prediction. Also, AI-driven chatbots and virtual assistants can deal directly with customers by answering payment-related questions, providing payment options, and even negotiating payment plans to enhance the smoothness of B2B collections.

Supplier Financing and Early Payment Programs

Early payments to suppliers are possible through a supplier financing program, also known as supply chain finance. The benefit of early pay is that the supplier gets paid on time, and the buyer can negotiate discounts for early payments. By introducing supplier financing and early payment arrangements into their operations, firms may enhance their cash flow and build strong working ties with their suppliers, which help lower their borrowing expenses. Such programs affect sectors with lengthy payment periods.

These payment policies safeguard the client-company relationship in the long run. A sense of trust builds among customers regarding the company’s services.

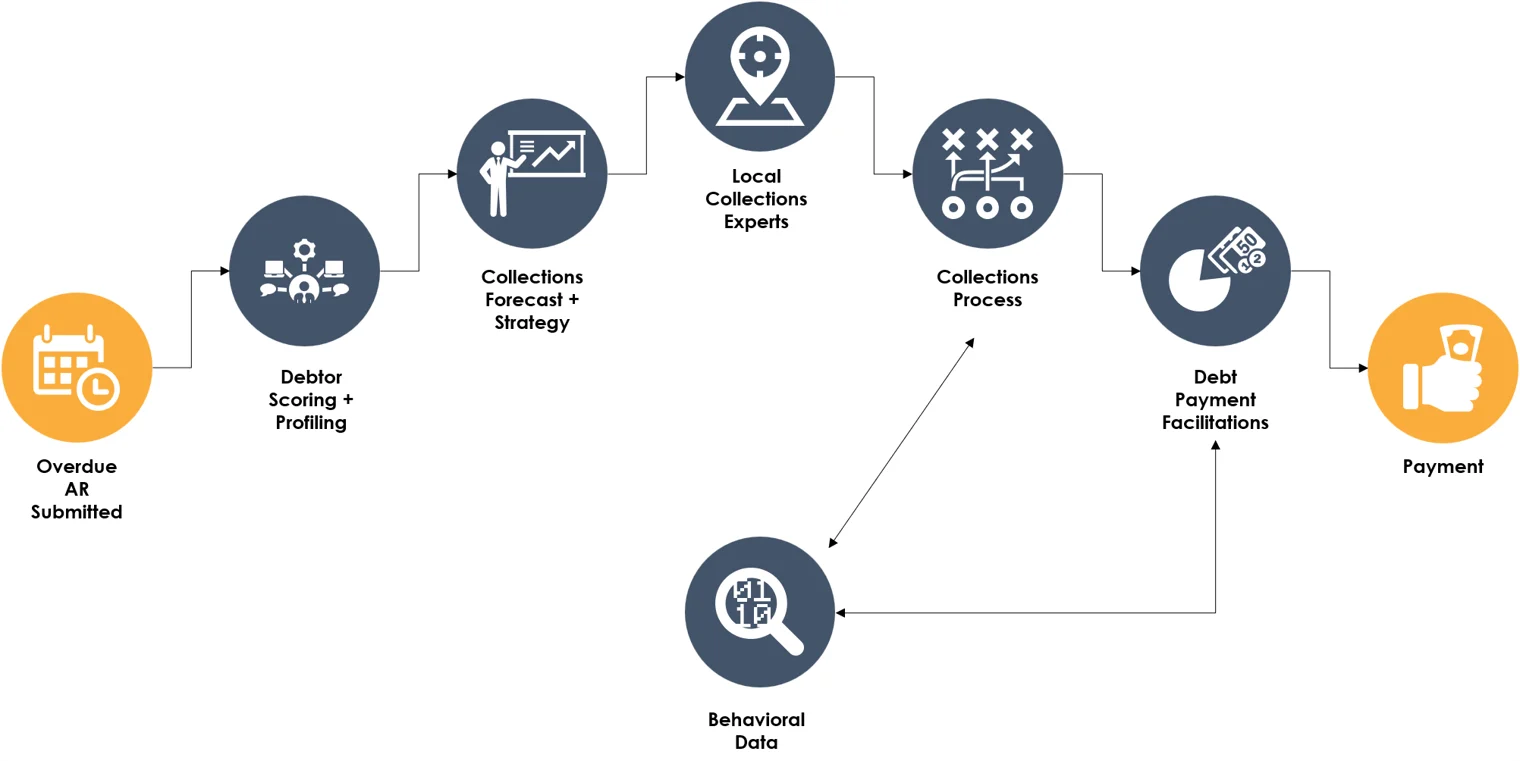

Debt Collection Services

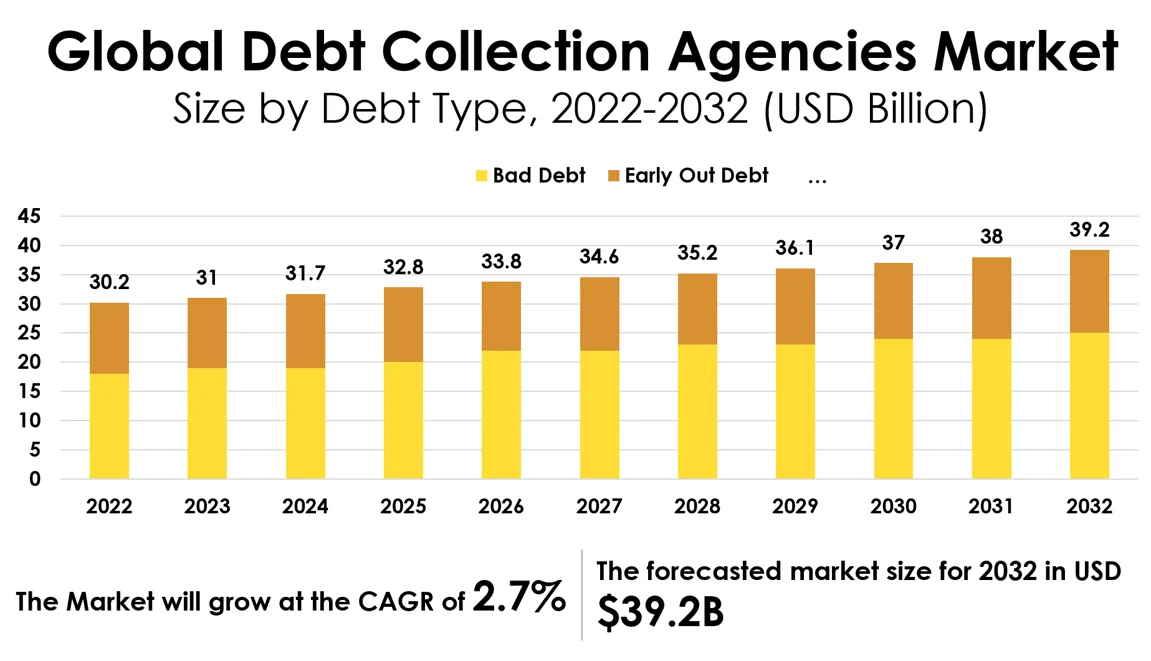

When traditional collection methods fail, businesses may resort to the services of specialized debt collectors. Such companies are well equipped to collect debts due to their negotiation skills or lawsuits. It is not a novel approach; however, the services employ state-of-the-art technology and data analysis to locate debtors most effectively and determine optimal collection strategies.

Third-party Collection agencies across the globe excel in recovering debt for their clients, which may be difficult for business owners in general.

Conclusion

The new ways of electronic invoicing, payment gateways, subscription billing for Mobile payments, blockchain, and Artificial Intelligence are transforming the world of B2B collection. Companies must accept these advanced ways as they would lead them towards achieving much in the current fast business environment. To be financially prosperous, one must always remain updated and go fully automated in invoicing or use blockchains and introduce AI into collection strategies. Now, companies must accept new technologies to manage debt collection recovery seamlessly.

Bill Gosling (BGO) has over 60+ years of experience in B2B collections, ensures trust-worthy services with a performance-based compensation policy to companies of all sizes, and helps recover unpaid invoices and outstanding debts with no hidden costs. Connect with our product specialist for more information.

Learn more about evaluating B2B collection performance in our whitepaper on measuring success from a dollars collected perspective.