Introduction

Delivering exceptional CX is crucial in the insurance sector as this is one sector that involves promises of protection that can be materialized only after ample paperwork and verbiage. For the UK insurance sector, delivering outstanding CX now is not merely a part of strategic planning but a concrete goal for 2024. With the onset of digitization, policyholders are aware, and they don’t just expect to hear the long wait music and mechanical conversation. The expectation involves efficiency, personal human touch, and technological practicality. It still seems unrealistic when we imagine a claim process like ‘slicing through the air’.

Tighten your seat belts as we are ready to dive into the most effective best practices that will transform your customer experience in the UK insurance sector from ordinary to splendid!

Customer Experience in the UK Insurance Sector

Quick fact!

The gross written premium of the United Kingdom (UK) general insurance market was GBP122.1 billion ($150.8 billion) in 2023 and will achieve a CAGR of more than 5% during 2024-2028.

The Association of British Insurers reported a 34% increase in premiums in the UK from 12 months to the end of 2023. However, the UK Customer Service Index revealed that customer sentiment in the insurance sector 2023 was at its lowest since 2015. This has resulted in a predicament of customer loyalty, with customers looking for other options. Now, insurers must strive harder to create and sustain loyalty from their customer base.

Hyper-Personalization: Beyond the Generic Greeting

Gone are the days when emails mentioning “Dear Valued Customer” were a thing. The customer’s data are now deeply analyzed by insurers to deliver customized experiences and to make customers feel valued and important. Let’s envision a situation where you receive a recommendation for policy renewal with your favorite travel destination picture in the background. Seems unbelievable. Right? But this is in!

“It was highlighted in Capco’s 2023 survey of UK insurance policyholders that consumers are willing to adopt enhanced product personalization – and are obliged to share added personal data to attain that benefit. 28% of those surveyed answered they would share additional personal data to get more personalized services”.

Best Practice:

By the adoption of advanced data analytics and putting your customers’ data into full use Hyper-personalization in the interaction can be achieved. A regular experience can be transformed into an exceptional one by using Predictive algorithms to recommend services and products based on customers’ choices and behavior patterns.

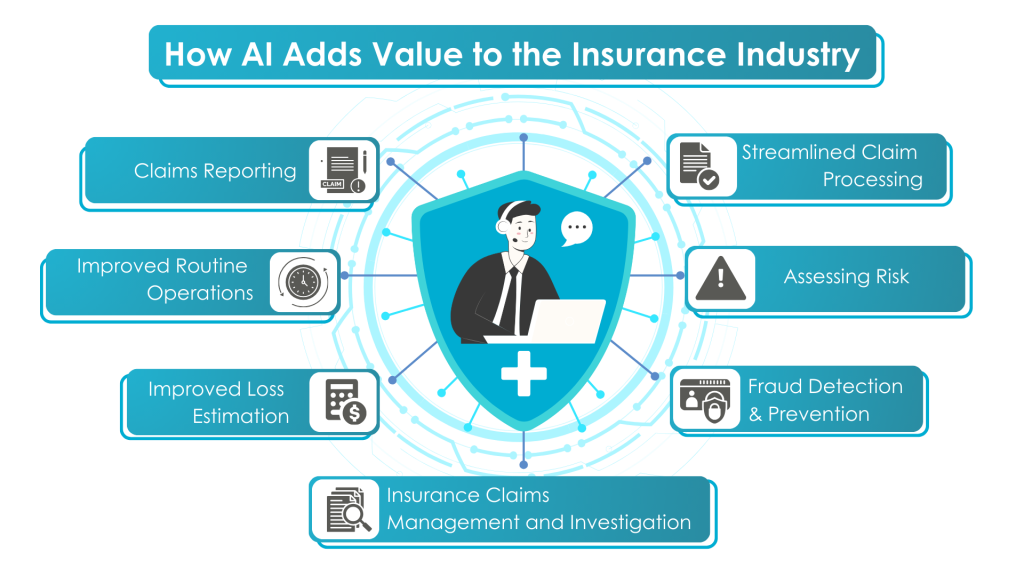

AI and Chatbot: The New Besties in Town

From mechanical, boring, and repetitive responses to personal and human interaction, AI and chatbots have accomplished a lot. Now, the chatbots can manage thoughtful dialogues and, at times, even talk humorously. They have transformed into an associate who helps you understand the clause of a policy or are also available to listen to your frustration regarding a claim.

The Carrier Perspective: 2024 Claims Insights report demonstrates that 83% of UK insurers have already implemented or are in the process of implementing AI Chatbot or generative AI to aid enhanced claims resolutions.

33% of insurers in the UK are concerned about seamless AI integration into a company’s operations.

Best Practice

In order to facilitate unified interactions, the UK insurance sector should leverage AI. Also, to handle intricate queries and deliver accurate and prompt replies along with a human touch, companies should strategize to invest in advanced natural language processing tools.

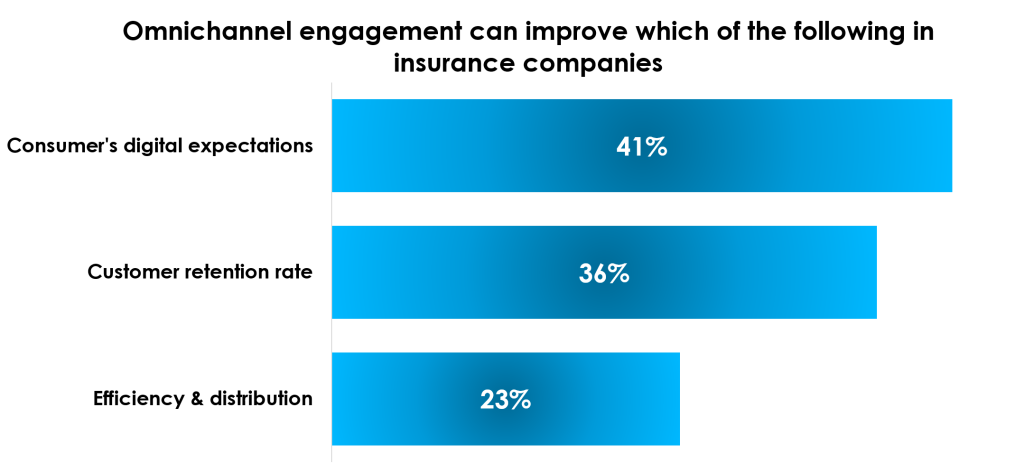

Omnichannel Experience: Seamless transfers

Customers today switch from one communication channel to another in the blink of an eye. It’s frustrating for customers to stay in a queue for a long time and then repeat their whole issue from the start to a live chat. Omnichannel experience is the feature that defines the future of enhanced Customer experience in the UK insurance sector, where the customer journey can be both managed and traced equally.

According to a Capgemini survey report, over 50% of customers use three or more channels to research and buy insurance coverage.

Above 50% of customers expressed they use the chat features mentioned on their insurance firm’s website, mobile app, or call center, jointly with traditional channels (branch/agent/broker) to get responses to queries.

Best Practice

For a peaceful interaction, all communication channels should be integrated into a unified system. Also, in order to deliver a seamless experience, it is vital that customers’ conversations are transferred from live agents and mobile apps to chatbots without missing the continuousness and context.

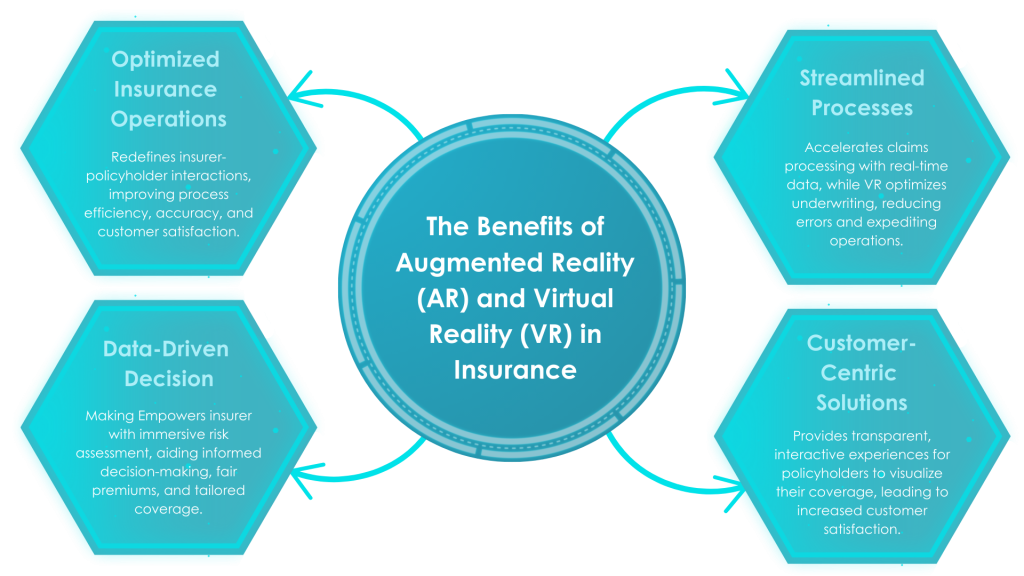

Virtual Reality (VR) and Augmented Reality (AR): The Future is Now

Previously, Virtual Reality (VR) and Augmented Reality (AR) were things of sci-fi. However, they have now stepped into the world of insurance and offer immersive experiences. Now, customers can take policy walkthroughs to AR-based risk assessments. These technologies are setting up higher standards for customer engagement and making the journey smoother.

Best Practice

Like mentioned above, with the advent of modern technology AR and VR have started taking over the insurance world by delivering exceptional experiences. Virtual policy demonstrations and risk assessments based on AR establish new standards of customer experience.

Ethical AI and Transparency: Building Trust in a Digital Age

At present, data security is a major concern when the whole world revolves around statistics and information. Thus, with the onset of technology, leveraging AI security and transparency has become a major concern. It’s essential that customers feel confident that their data is being responsibly.

The basic component of any AI system is data, so the customers must be ensured by the insurers how their data is being used. And that their data processes adhere to GDPR (General Data Protection Regulation) and their AI systems are protected to cyber-security threats. If not, organizations expose themselves to grave risks, like the case of Swedish insurer Trygg-Hansa, who received a €3 million fine for a breach of GDPR in 2023.

Best Practice

Transparency in communication and ethical AI practices should be promoted. Customers should be clearly explained how their data is being used, and communication about privacy practices should be reviewed and reflected. Also, for the purpose of impartiality, AI algorithms should be frequently audited.

Sustainable Practices: Say Green!

It’s an age where customers are aware of climate change and prefer companies that work towards a green future. Thus, in response, insurers are also adopting climate-friendly, sustainable practices such as carbon offset initiatives. It’s not just limited to protecting people but also being climate warriors.

A global study conducted by Cognizant in partnership with Oxford Economics surveyed 3,000 senior executives, including 295 from the insurance industry. It was found that 65% of insurers rank sustainability as important in the overall business strategy.

Best Practice

It would be a smart move to integrate sustainability into your corporate and business model. Proposing options like *green insurance *carbon offsetting *reducing carbon footprint, and talking about environmental initiatives to grab the attention of nature-minded customers.

Wrap up!

A customer experience revolution is ready to take over the UK insurance sector. New models are set for exceptional customer experience by insurers with the assistance of advanced practices and technologies. However, these technologies and Best Practices for enhancing customer experience in the UK insurance sector are making the business efficient and satisfying for the insured and competition-friendly for the insurers.

So, let’s hope for a future where insurance is not just a policy but a positive, engaging, and notable share of your life.