Introdciton

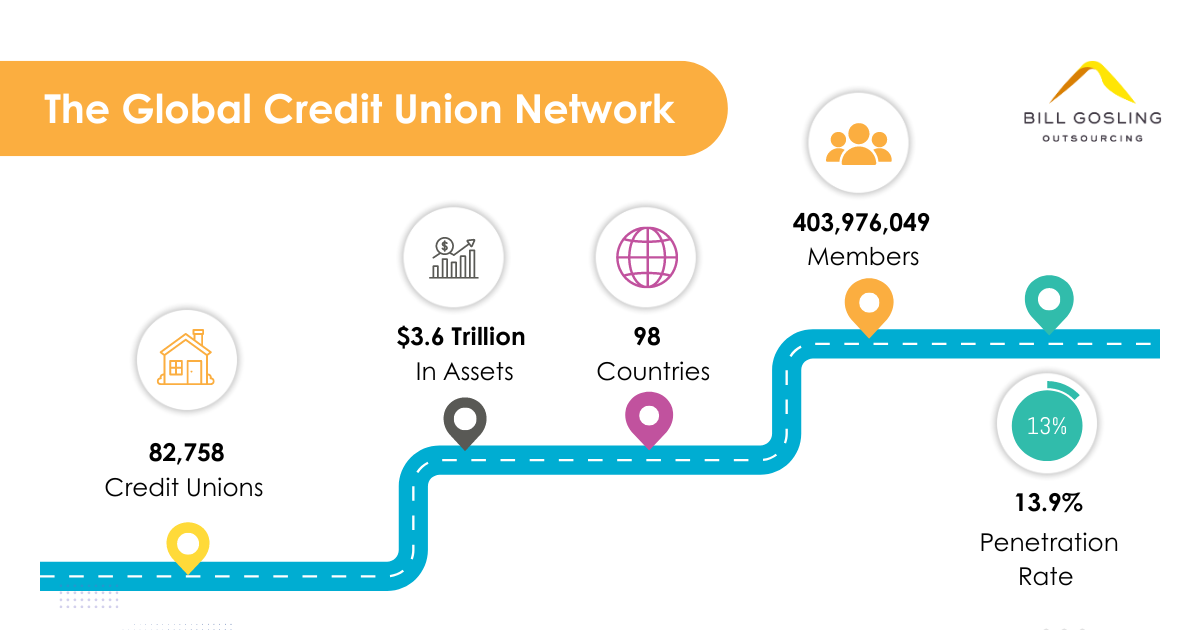

In the times of digital money, online transfers, Buy Now, Pay Later, and other Credit Unions have proved more than financial institutions. Embracing the dynamic financial requirements and technological progressions, Credit Unions have become major examples of innovation and inclusion. Credit unions are a vital and proud portion of the UK economic scene, serving over 1.5 million members, including 100,000 junior depositors.

As per the latest data from the Association of British Credit Unions Limited, there were 246 credit unions in the UK.

1. Adopting the Digital Shift

Digital transformation has become an integral part of businesses across the board of every industry, and it’s not just a catchphrase now; similarly, it has not left the UK Credit Unions untouched. The need to deliver exceptional, customized and seamless CX by member-owned financial cooperatives is extremely imperative in this digital age

We will discuss digital transformation, its role in remodeling CX, and UK Credit Unions and why it’s crucial for their future success.

2. Accepting a Digital-Forward Approach

Previously, the UK credit unions were conventional institutions that were community-focused and depended on personal interactions. Nevertheless, digital technology brought a change and inculcated the desire in members for similar convenience and accessibility from their Credit Unions as bigger financial institutions.

Brands that hold the customer as a priority when deploying their digital transformation strategy experience various pivotal inter-annual advantages, including:

- 75% growth in annual revenue increase

- 27% more probable to report a reduction in service costs

- 85% upsurge in cross-sell and up-sell revenue

However, credit unions face difficulties in holding their feet in a digitally driven financial world, also the large, tech-oriented banks have raised customer expectations to new heights.

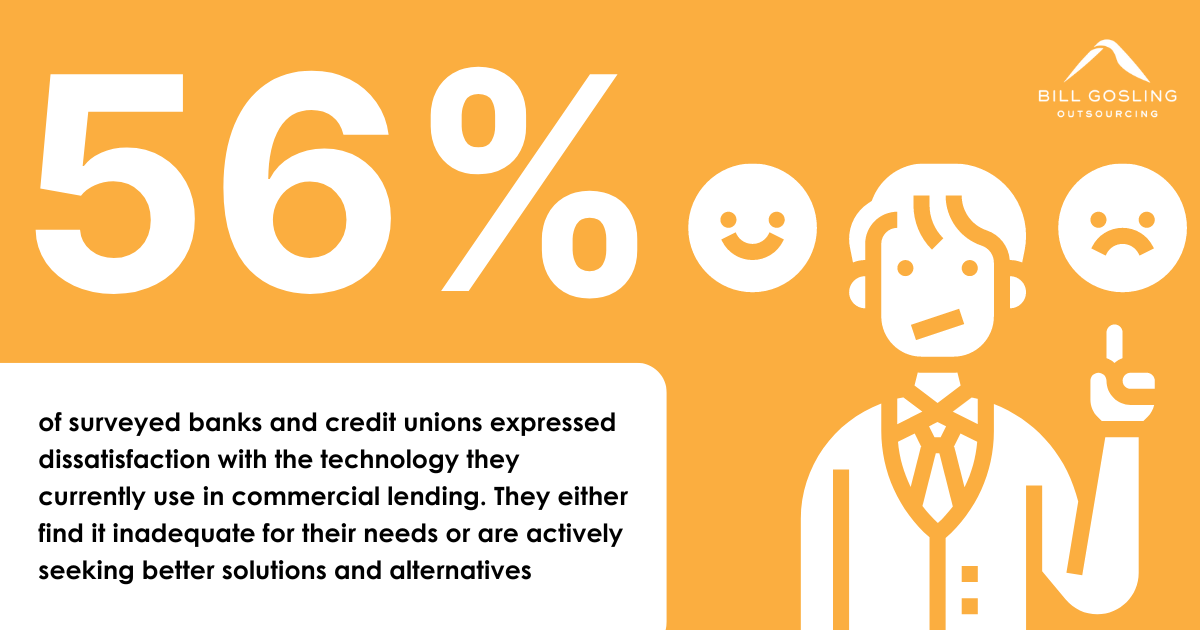

Five Primary Reasons Credit Unions Lack Good Customer Experience

- Obsolete Technology: Modern customers desire vast digital offerings and fast service. However, Credit Unions count on legacy systems that often cause frustration in digitally influenced customers.

- Inadequate Online and Mobile Services: Omnichannel is the new soul of communication. Customers want to access services from and through different channels. The lack of these channels makes the experience unpleasant and frustrating.

- Competent Processes: Short waiting times and faster resolutions in services like loan approvals or account updates make the customer journey smooth and convenient. This can be achieved through a well-trained manual and efficient processes.

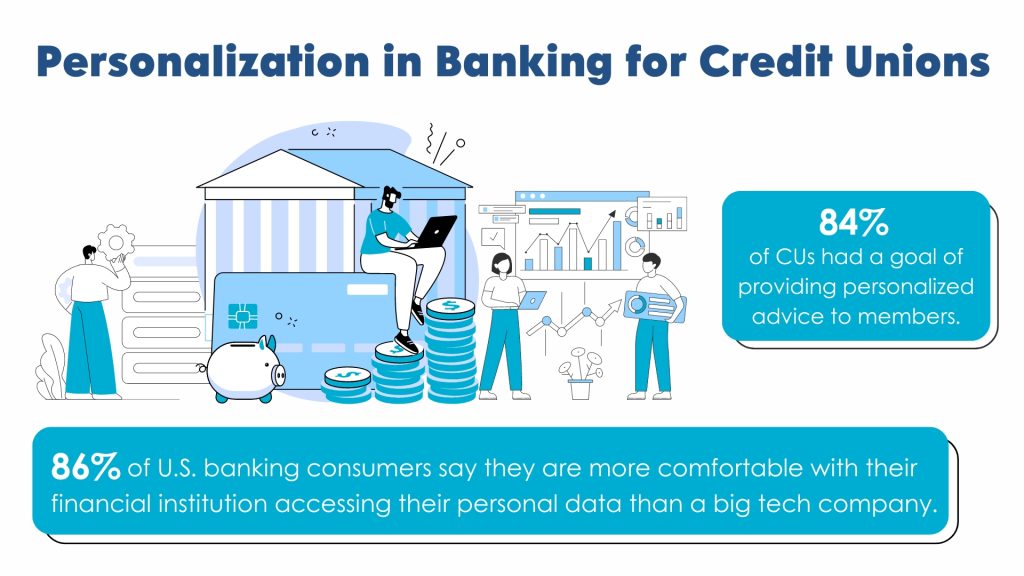

- Absence of Personalization: The lack of data-driven insights makes it difficult for Credit Unions to offer customized and targeted products and services, and this makes the customer feel unrecognized.

- Insufficient Customer Support: Inadequate resources and untrained staff can lead to poor customer support. With customers’ queries remaining unanswered and tasks not being appropriately handled, incompetent customer support leaves customers discontented.

The Role of Digital Tools and Platforms in Enhancing CX

The best sources to transform CX in UK Credit Unions are Digital tools and platforms:

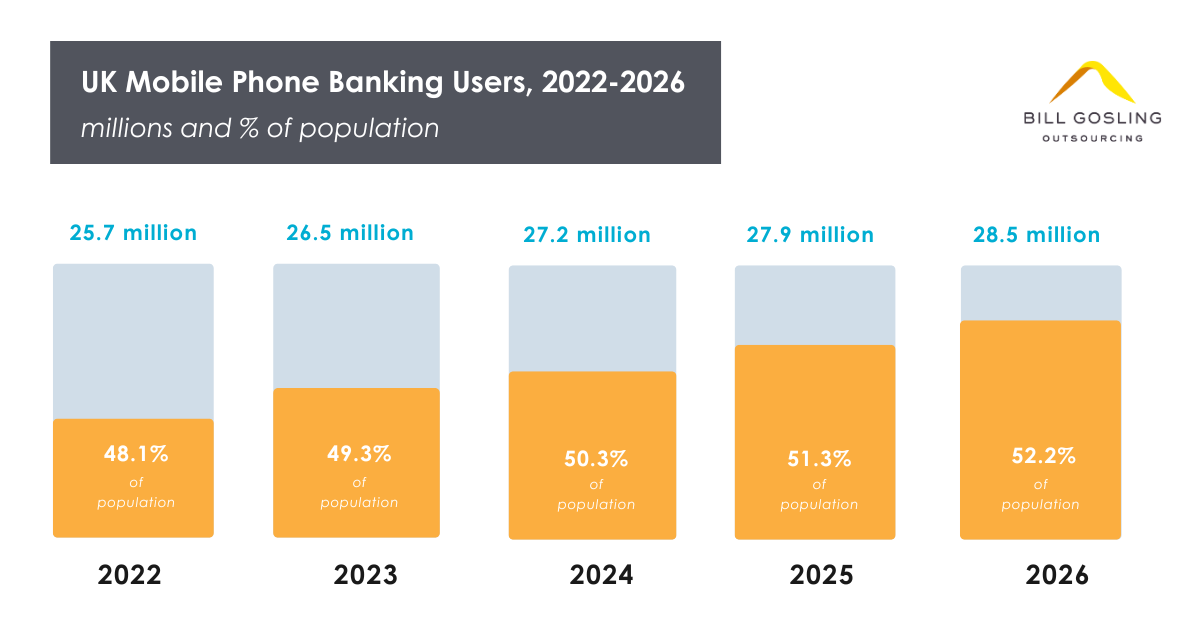

- Mobile Banking: Mobile banking has changed the whole method of banking. It has enabled users to access accounts in one tap, delivering suitability and user-friendliness and ultimately boosting CX.

- Online Banking facilities: Online banking services have recently proved to be game changers. Members can manage their accounts and loan submissions from around the world. A unified and comprehensive online service greatly influences CX.

- AI-enabled Customer Support: Customized interactions are endorsed by AI tools such as Virtual assistants and chatbots. These tools make the customer journey well-informed and personalized.

Customer experience in UK Credit Unions can be awesomely optimistic with the proper implementation of digital transformation. Some of the benefits include:

- Enhanced Approachability and Expediency: round the clock access to the accounts enables the members to efficiently manage their finances. Mobile apps and online banking have streamlined the transaction process.

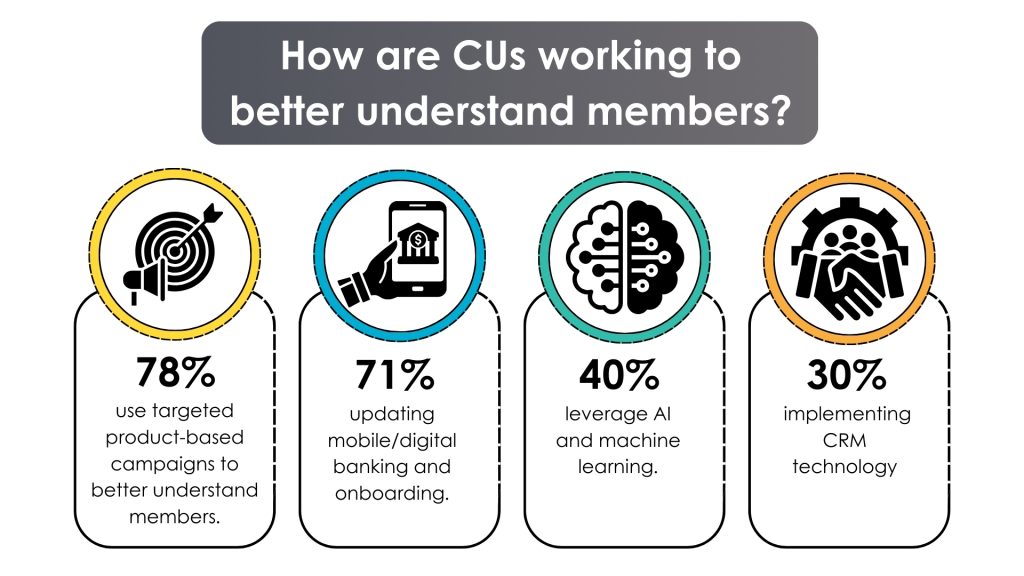

- Tailored Member Services: By deploying data analytics and AI Credit Unions can comprehend behavioral patterns of the members. This analysis further helps in customizing plans and financial products and services as per individual requirements and choice.

- Improved Productivity: Digital tools substantially decrease the average handling time invested in managing accounts, loan processes and transactions. This leads to less waiting time and more satisfied and contented customers.

- Fostering Member Engagement: Stronger relationships are nurtured through consistent, implicit engagement and interactions. This engagement is developed through digital communication channels such as chatbots, email and and social media.

Final Words

The UK Credit Union industry is at such a stage where adopting digital transformation is necessary for an exceptional Customer Experience. The industry has to start fresh, leaving behind obsolete practices by embracing digital tools and methods.

One needs to understand that, at this point, AI-enabled customer support and all-inclusive online services are vital aspects of delivering tailored and enhanced CX. With the evolution of the financial sector and increased customer expectations it’s imperative for Credit Unions to prioritize digital innovation to thrive and succeed