Introduction

Today the progression rate of the UK financial sector is faster than ever. The movement of money is restructured by the development in technology, expectations of customers and legal compliances. The whole process of payment, saving and investment is reformed by the upsurge of banking driven by AI, embedded finance, in fact the financial services sector is going through a major transformation. The question is how to stay ahead in a sector where compliance and innovations are taking place at the blink of the eye.

Fasten your seat belts as we take you to a drive for understanding the latest Key Financial Trends and insights for UK in 2025

- As per the latest data available in the House of Commons Library report on Financial services in the UK, the financial and insurance services sector’s contribution to the UK economy was £208.2 billion, which was 8.8% of the total economic output.

According to the Ideal Team Group’s report on The Top 5 Trends in the UK Financial Services Industry the UK Financial Services sector is anticipated to grow at a 24% CAGR, attaining a market volume of $127.3 million by 2029.

Source: UK Financial Services Industry A Zensar POV

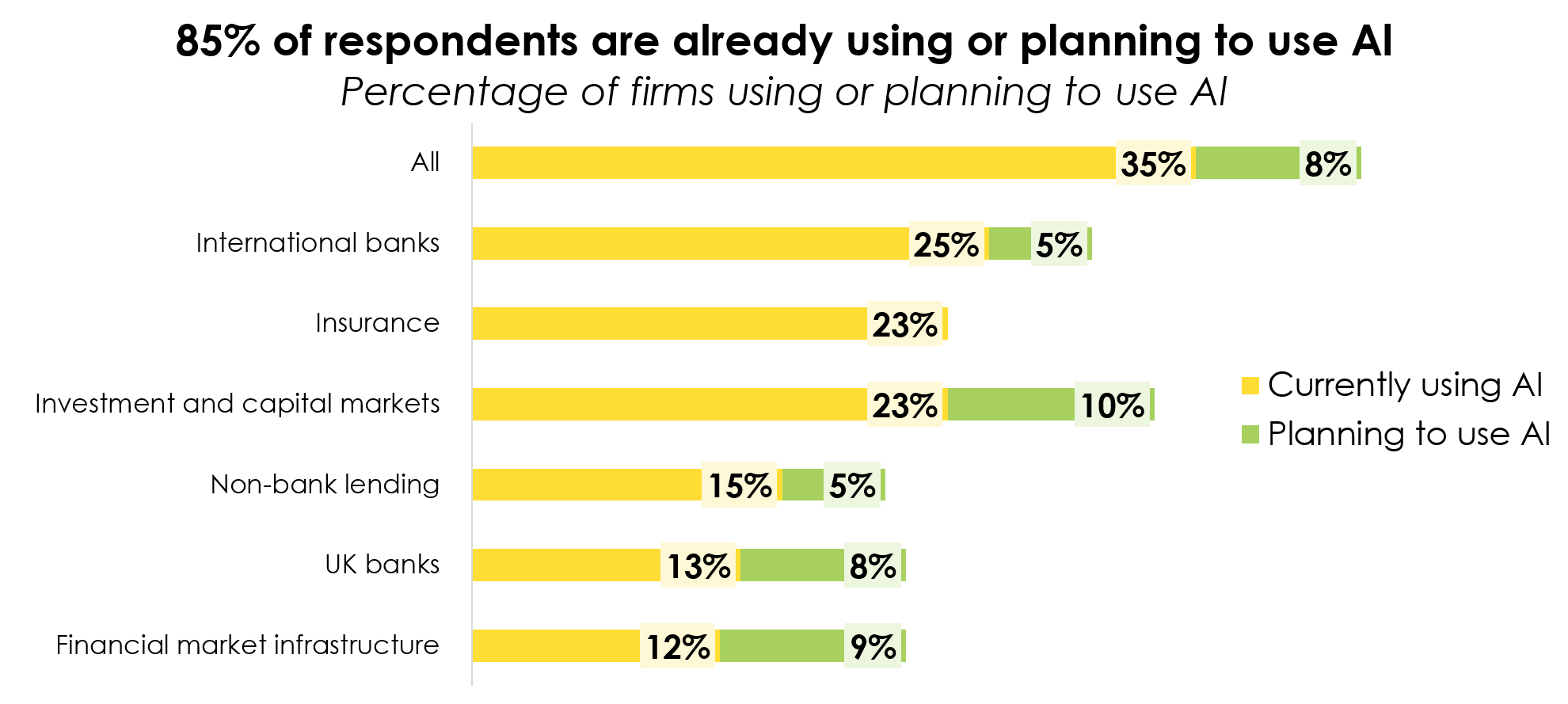

- As per a report of a Survey conducted by the Bank of England, Artificial intelligence in UK financial services – 2024, 75% of financial firms in the UK are already using artificial intelligence (AI). Also, further 10% are planning to use AI over the next three years.

Source- The Bank of England, Artificial intelligence in UK financial services – 2024

- Security is considered the most critical factor in data collection by 94% of consumers in the UK financial sector.

- The Macro Global report on The State of Open Banking in the UK: 6 Years In, What’s Next stated that only 10% of the UK population utilize Open Banking .

- According to the RFI Global Report on The Future of ESG in the UK Financial Services Sector, at least one sustainable finance product is held by 21% of UK consumers.

After reading the trends, we can understand that the growth in the financial sector is now not just about beneficial investments but also about a customer-centric approach, embracing technology, and swiftness in adopting changes. Today, the objective is to provide customers with personalization, a sense of security, and convenience. The transformation through AI and embedded finance focuses on making the customer journey smooth and seamless.

The new dawn of the financial sector is being designed by leveraging real-time data for farsighted decision-making and deploying automation to streamline CX. Thus, the new era of UK financial services is moving towards transformation.

Looking to dive deeper into how UK banking is transforming? Explore these related articles that complement Why Tailored Services Matters in Modern Banking Setup in the UK:

Sources:

The Macro Global report on The State of Open Banking in the UK: 6 Years In, What’s Next