Introduction

The economic climate today is dynamic and swift. The traditional debt recovery methods depend heavily on manual methods. Strategies like general communication approaches and call centers are unable to cope with the fierce pressure. With the rise in customer expectations and strict compliance requirements it becomes imperative for companies to switch and Leverage advanced technological solutions for Efficient Debt Recovery.

According to industry reports, advanced technologies have increased debt recoveries by 65%.

There is a transformation in Debt recovery. From manually fixed call scripts to leading-edge technology, the whole process has evolved to a more effectual and sympathetic one. The way organizations approach collections are reinvented by multi-channel communication, AI, data analytics and automation. However, deployment of these technologies leads to enhanced CX, increased recovery rates, and cost reduction.

1. Predictive Analytics: Aiming the Right Customers at the Right Time

Generic collection strategies are a thing of the past. Customers’ data related to payment history, credit score and behaviour pattern are analysed through. Predictive analytics to categorise customers who are probable to pay.

- Intelligent Segmentation

- Personalized Outreach

Example: To avoid delinquency, a flexible repayment plan can be offered to a customer in case predictive models identify a customer with several late payments

2. AI-Powered Chat-bots: Automating Customer Interactions

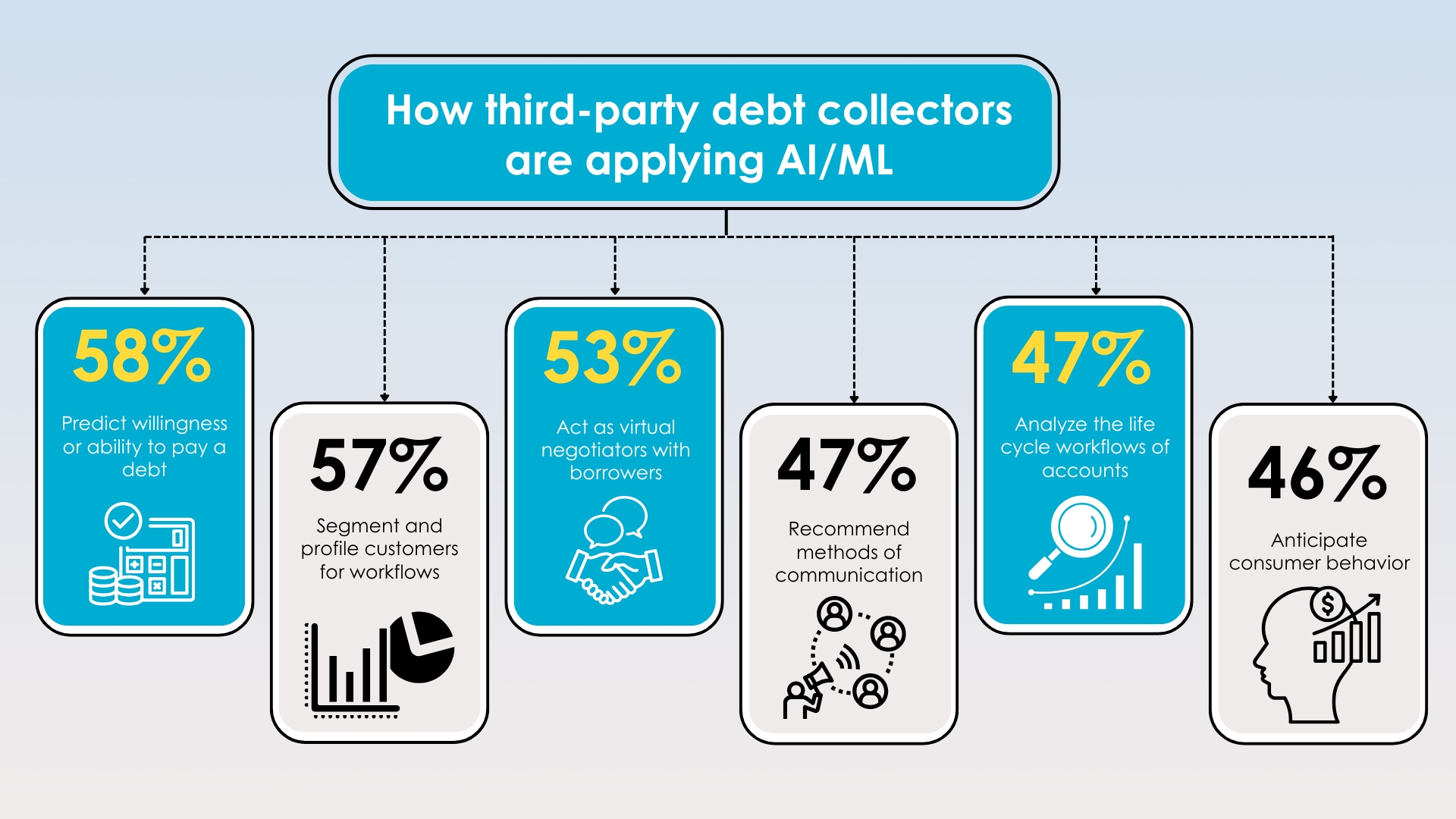

A lot of time is saved when routine conversations are automated by AI Chat-bots. Also, they offer 24/7 support. Likewise, , According to a TransUnion report, 11% of debt collection companies use AI in their tasks. Agent workload is considerably reduced when tasks like payment reminders, balance inquiries and repayment plan set-up are handled by Bots.

- Seamless Payment Collection

- Escalation to Human Agents

Example: A friendly payment reminder can be sent to a customer and he can make the payment via the payment link provided in that message.

3. Machine Learning: Optimizing Collection Strategies Over Time

Companies can improve their strategies by receiving insights and analyses obtained through Machine learning (ML) models. As ML evaluates previous conversations and recovery patterns.

- Adaptive Campaigns

- Dynamic Segmentation

Example: Gradually system understands that customers in a particular area respond more effectively to email reminders than phone or messaging. Thus, the outreach strategy is modified.

4. Omnichannel Communication: Meeting Customers Where They Aree

A better customer engagement is developed through Omnichannel communication platforms as it provides consistency. Also, the customers todays want to interact on various communication channels, calls, emails, messages, or social media.

As per a report, the application of an omnichannel digital strategy witnesses a 40% increase in payment arrangements, and the cost to collect is cut by 50% through a virtual agent approach.

- Consistent Outreach:

- Improved Engagement

Example: A customer receives an email notification about a missed payment and later connects with an agent via live chat to negotiate a repayment plan.

5. Automated Workflows: Streamlining Processes for Faster Recovery

Today with the help of technology repetitive tasks are automated. Works like sending reminders, report generation and marking delinquent accounts are automated. This as a result reduces, human workload and faults and also decreases the operational expenses.

- Automatic Escalation

- Instant Reporting

Example: Automatic reminders are sent for a payment overdue for more than 30 days. Also, a self-service payment link is provided.

6. Speech Analytics: Unlocking Insights from Customer Conversations

Speech Analytics can be a great tool for companies that are involved in collections based on phone calls. It extracts a treasure of insights from agents’ conversations with the customers. Also, it can identify keywords, emotions, or sentiments, which assists the agents in making the most relevant decisions.

- Emotion Detection:

- Compliance Monitoring:

The objective is to focus on words and address the issues before they convert into legal issues.

Example: If a distressed customer’s hardship related to finances is identified. A restructured repayment plan is offered to evade default.

The purpose is to get a grip on the customer before it becomes a lawsuit. As per Pew Research, the percentage of civil lawsuits related to debt has risen to 42%.

Example: If a conversation reveals a customer’s financial hardship, the system suggests offering a restructured repayment plan to avoid default.

7. Cloud Solutions: Ensuring Scalability and Security

In order to grow their business swiftly, migrating to the cloud is a need of the hour. The migration of Debt recovery technology to the cloud also relieves a company from upholding an infrastructure in their vicinity. Features like securing data storage, integration, and flexibility are offered by cloud platforms.

- Real-Time Collaboration

- Data Security

Example: The cloud system scales automatically in order to manage high volumes of calls during peak collection periods. It helps in ensuring that no call is abandoned.

Conclusion: The Future of Debt Recovery is Digital

Adoption of digital debt recovery is now a pressing priority for companies that aim to thrive in this dynamic sector. New technologies like automation, AI, predictive analytics, and omnichannel communication are transforming the whole process, making it more customer-oriented, upbeat, and practical.

Companies are empowered by advanced technologies, customer relationship is enhanced along with quicker debt recovery, cost cutting and improved compliance. Today, businesses have the opportunity to obtain real-time insight, augment outreach strategies, and streamline recovery processes by deploying AI, speech analytics, and predictive models. The deployment of these technologies can deliver improved results.

We bring 60 years of expertise in Account Receivable Management at Bill Gosling Outsourcing. With our comprehensive services, we help companies to recover unpaid invoices. We enable you to focus on expanding your business, and our well-trained professional team can be involved in recovering debt and safeguarding your brand name and reputation. Join our hands and achieve success in debt recovery and improved revenue.

Explore our whitepaper on global debt recovery strategies to gain deeper insights into effective international collection approaches.