Introduction

Let’s visualize a situation where you are sitting in an important client meeting and your phone rings. Considering the gravity of the situation, you didn’t pick up the call. Within a few minutes, you received a message stating that “someone was trying to reach you,” but you didn’t know who it was. Then, you received an email regarding an overdue account. Finally, you log in and start a chatbot conversation, but at this point, you are already overwhelmed and annoyed.

However, imagine a distinct situation where you received an email about an overdue account, followed by a message notification and a chatbot already identifying your issue history.

That’s what omnichannel engagement is- and it’s transforming the ecosphere of debt collection.

What Is Omnichannel Engagement, Really?

The meaning of Omnichannel engagement is delivering an integrated, unified communication experience across multiple channels that includes phone, email, SMS, chat, social messaging, and self-service portals and sustaining consistency and context across the board.

So, let’s be clear: It doesn’t mean additional communication but smarter, more connected communication. Imagine the convenience it provides. Instead of shouting into different amplifiers, you can have a calm and meaningful conversation with someone in their preferred method.

As a matter of fact- debt collection is a subject that is not widely enjoyed. If we talk about customers, it’s stressful and often embarrassing for them. For collectors, it’s a battle to balance empathy with effectiveness. This is precisely where omnichannel comes into play.

A 24% higher recovery rate is reported by companies employing omnichannel strategies than those relying on single-channel methods

1. Modern Consumers Expect Digital-First Experiences

As per Experian’s article Omnichannel collections, 52% of consumers who visit a digital site will proceed to a payment schedule. Without exception, debt collection comes under this. People want the liberty to:

- Pay on the go.

- Set up preferred payment plans.

- Make queries without making a phone call.

When you are offering multiple digital channels, you are making your collection process easier and frictionless.

2. Increased Reach, Response, and Recovery Rates

What if your contact strategy only relies on outbound calls? And the customer screens the unknown numbers like the majority of us do. Unfortunately, you made the wrong move.

Now visualize this in its place:

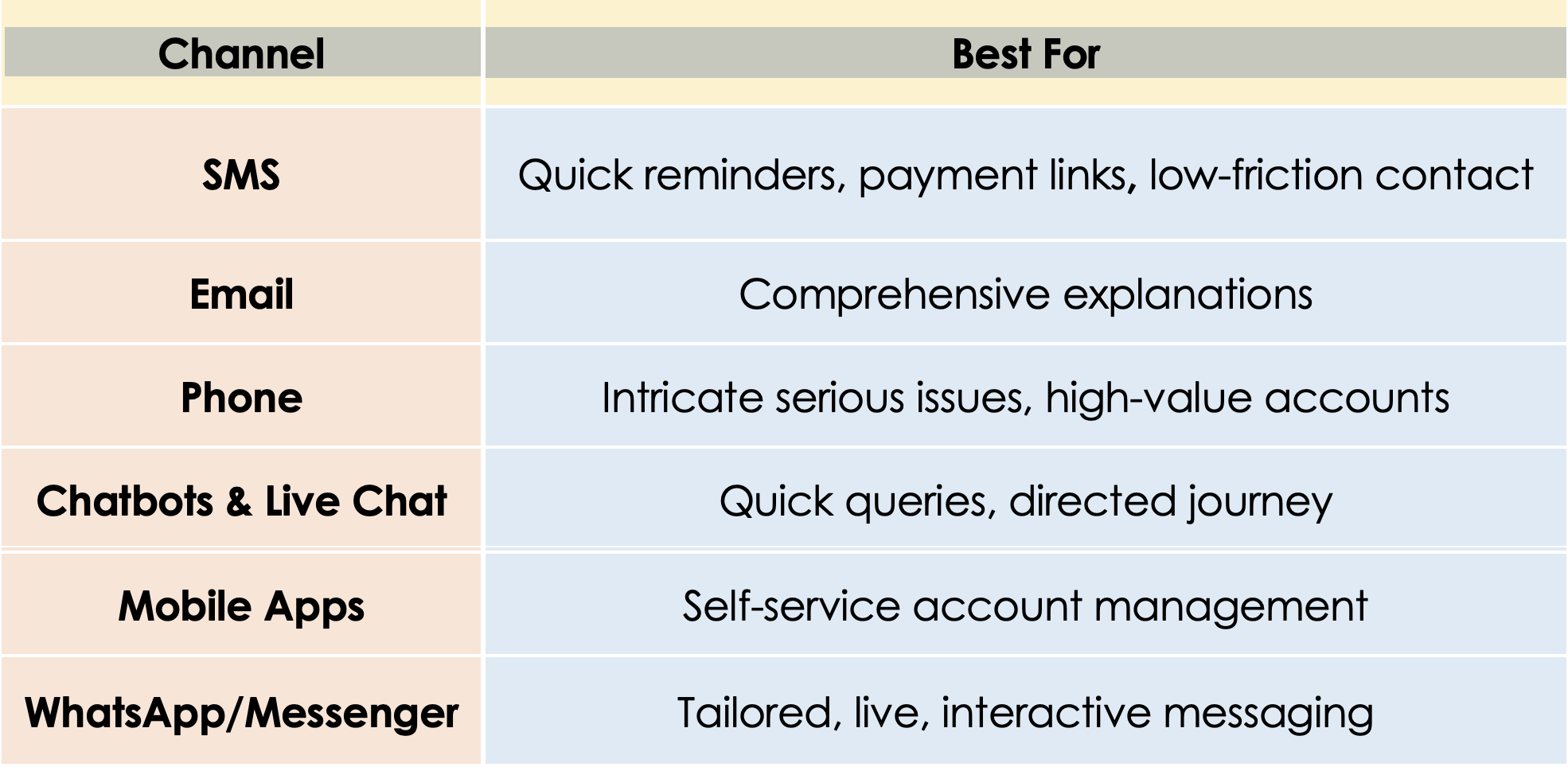

- Email: Sends the initial notice and describes choices clearly.

- SMS: Follows up with a link to pay or schedule.

- Chatbot: Replies common queries or transfers to a live agent.

- Phone Call: Utilized phone calls strategically when required for a personal touch

A comprehensive audit track is created as Omnichannel platforms record all customer interactions across channels and, as result compliance risks are reduced by up to 60%.

3. Better Data = Better Personalization

A smart breakdown and personalization approach is followed by omnichannel platforms as it’s an integrated system with real-time analytics.

You can comprehend whether the customer is more responsive to Messages than email

- Do they engage more in the evenings rather than the mornings?

- Did they leave after reading the first couple of lines of your previous message?

Now, you can fine-tune your approach to incline with their actions.

Real-World Example: Omnichannel in Action

Day 1: George gets a friendly email presenting the balance and providing payment choices.

Day 2: A text notification is delivered with a link to a self-service portal.

Day 3: George clicks on the portal and looks for the options but doesn’t make the payment.

Day 4: One-click payment plan or live agent support is offered through a popped chatbot.

Day 5: George sets up a plan for payment without ever picking up the phone.

Channels That Power Omnichannel Collections

Every channel in the Omnichannel family plays a distinct role. And here’s how you can utilise their potential to the maximum.

Best Practices for Smart Omnichannel Engagement

Gain Consent First

Different communication channels have a strict selection rule. It’s vital to receive explicit consent before contacting the customers and giving them the authority to choose how they want to be reached.

Start With the Customer’s Preferred Channel

Guess work is not allowed! Let the customers choose their preferred mode of communication: texts, emails, calls, or app notifications. This nurtures loyalty and enhances response rates.

Maintain Context Across Channels

You need to know if your customer has spoken to the chatbot on Monday and the phone rep on Tuesday. Friction is avoided when the transition is seamless.

Be Empathetic, Not Pushy

Voice pitch, modulation, and tone matter more than we think. The approach should be solution-oriented, empathetic, and supportive.

Optimize for Mobile

Mobile is the primary interaction device now a days. Thus, it should be ensured that every link and chatbot works smoothly on smartphones.

The Results Speak for Themselves

As per a FICO survey in the UK:

- 52% of customers want to be reminded about late payments via SMS and mobile app

- 48% of customers said they probable to respond to a cordial and helpful message

- 30% of customers said that they would choose to pay through a website/online portal

Final Thoughts: Meet Customers Where they want to

Repeated calls and aggressive emails are on the horizon of the future of debt collection. Now, it’s all about wise, tailored, and thoughtful interaction- across the channels used by the customers. Omnichannel engagement assists you in meeting people where they are, as per their choice and timings. When appropriately implemented, it transmutes collections from a terrified process into a seamless, humble interaction. For the reason that when customers feel valued, heard, and endorsed -they possibly respond.

Read More : Third-Party ARM Goes Omnichannel: Key Trends Shaping 2025 Collections

Sources:

Omnichannel marketing statistics

Engage Better, Collect Smarter: Omnichannel Strategies for Debt Recovery

Omnichannel collections

Why Omnichannel Collections Matter: Strategy and Benefits

Does Your Omnichannel Strategy Match What Customers Want?