Late payments are like those fluorescent tubes that blink and don’t produce bright light; they are irking, tenacious, and challenging.

For utility providers in the UK, late payments are not secluded to just bookkeeping. It is handling a tricky situation where the organization has to maintain customer relationships, maintain cash flows, and sustain rising operational pressures. Economic recession and other fluctuating priorities are an inevitable part of today’s volatile business setup, and thus, recovering late payments has become an art rather than just a task. However, with the correct approach and implementation of innovation, this task could become swift and seamless. Tackling Late Payments: Strategies for UK Utility Providers can serve as a crucial guide in navigating these challenges effectively.

Utility providers must embrace a progressive approach that blends innovation and empathy, to prevail over late payments. Instead of being a repeated issue late payments can be changed into prospects for building strong customer relationships and maintaining liquidity, if the companies can adopt

- Tailored payment solutions,

- Proactive communication, and

- Cutting-edge technologies

This blog will discuss the approaches UK utility providers can implement to turn the tables on late payments. New technologies like predictive analytics, flexible payment options, and compassionate client engagement are the tools that can transform the pain of overdue invoices into a chance for relationship fostering. Let’s read and learn!

Ø Turning Data into Dollars: Predictive Analytics at Work

It’s no more sorcery to know in advance which accounts will pay late. With BGO’s B2B Collections Platform it’s not a fantasy to see the future beforehand. Predictive analytics is deployed by the platform to evaluate historical payment manners, recognize patterns and identify high-risk accounts. Predictive analytics enables utility providers to take actions like offering flexible payment choices and sending personalized reminders.

Why it works:

- You don’t live in uncertainty and don’t waste time for payments to come.

- Delays are reduced, and disputes are avoided as High-risk accounts get the required attention.

Empathy Meets Efficiency: Smarter Engagement

The efforts to receive overdue payments don’t mean sending consistent, aggressive emails or obstinate phone calls. BGO’s platform ensures to maintain harmony in customer-company relationship through trained empathetic professionals. The objective is strong collaboration through well-framed polite message reminders or humble calls from efficient and skilled agents.

Pro tip: A vital element here is Omnichannel communication. Customers prefer Different modes of communications. Some are comfortable with emails while other respond swiftly to messages. You can modify your outreach method on our platform to maximize the efforts.

96% of utility businesses deployover three communication methods: phone calls, email, social media, and messaging apps.

Flexibility That Fits: Customized Payment Solutions

With time and rising economic recession people and companies have understood the benefits of flexible payment plans. BGO enables the utility providers with solutions that are flexible and meet the requirements of clients. A common ground is being prepared through BGO platform to handle both personalized schedules and stuck payments. Especially in a situation when a considerable portion of the UK population is grappling with economic difficulties, with 15% severely affected by fuel poverty . Additionally, the middle 45% of the market is feeling the tension of mounting financial pressures.

The result?

Fewer payment disputes and happier clients, who feel supported, not pressured.

A McKinsey report stated that 25%of customers show readiness to change a service, which could increase significantly if energy providers address cost issues, improve customer awareness, and streamline operations.

Automation to the Rescue

Manual follow-ups and a web of spreadsheets are things of the past. Vital processes like sending reminders, tracking payments, and escalating overdue accounts are automated by BGO’s B2B Collections Platform. Through automation, time is saved, and no invoice goes unnoticed.

Bonus: However, the human touch is not lost with automation- critical cases don’t go unnoticed and are identified and intervened.

73% of utility companies employ intelligent technologies like artificial intelligence to enhance software performance.

Scaling for Success

Managing collections can become daunting when B2B clients grow with the rise in new utility providers. BGO’s platform can handle and manage business requirements, whether 100 invoices or 10,000.

Why BGO’s Platform Is the Perfect Fit for UK Utility Providers

The objective of the utility sector can’t be just staying afloat; it’s about upholding trust and dependability in an aggressively competitive market. The relationship between customer and utility provider can be strained by late payments, however, but by leveraging right tools providers can change the narrative.

What makes Bill Gosling’s Outsourcing different?

- Strategies backed by Insights: Foresee and take action before escalation.

- Customer-Oriented Approach– Dealing with empathy and resolving payment delays.

- Seamless Integration: It smoothly transitions with your existing systems.

Conclusion: Seizing the Moment—A Future Free from Late Payments

Late payments are an unavoidable tornado in the utility sector; however, they can be managed and restrained by deploying the required tools and approaches. Bill Gosling Outsourcing’s B2B Collections Platform is a revolution in accomplishing and alleviating payment delays. It’s a seamless combination of cutting-edge technology with human-centric proficiency; it enables and empowers utility providers to create lasting trust and loyalty and maintain a consistent flow of money by payment collection.

It’s the age of adopting new technology and shifting gears to leave behind the phase of passive collections; let BGO’s B2B Collections Platform be the cornerstone of your late payment strategy. And transform collections into strong connections; it’s not just handling late payments. You are building a future where invoices narrate the story of enhanced customer relationships.

Are you ready to change the narratives? Let’s make late payments an old story!

Customer Experience Trends in Utilities 2023

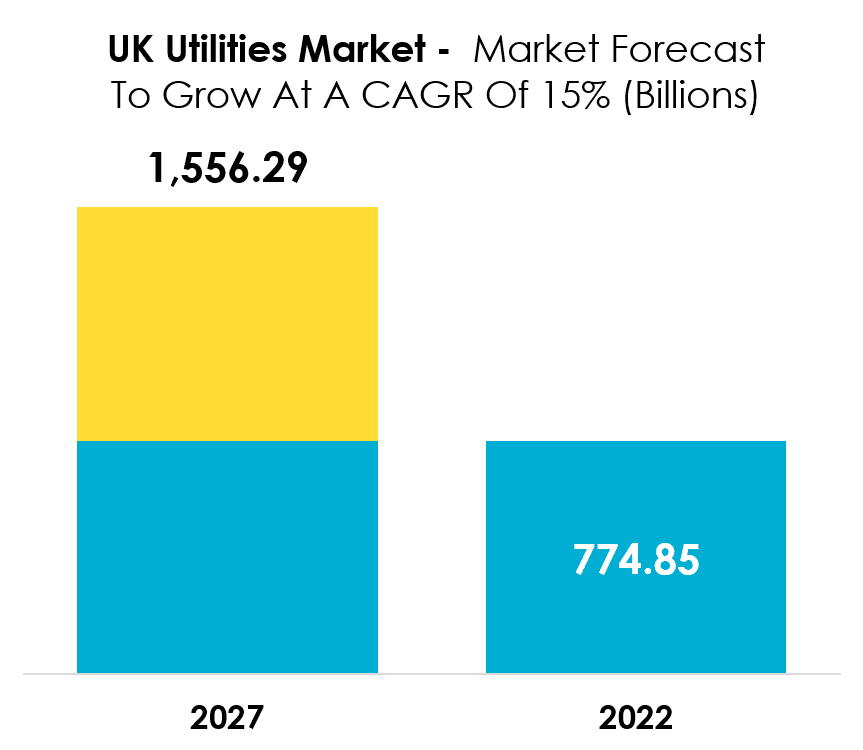

Trends and Market Insights in the UK Utilities Sector in 2024

Trends and Market Insights in the UK Utilities Sector in 2024

How UK energy retailers can rethink strategies as the market reopens.

Customer Experience Trends in Utilities 2023