Introduction

The utility sector is the spine of modern lifestyle. Enabling smooth functioning of life, the utility sector comprises services such as water, energy, sewage management, etc. Although this sector stays in the center of everyday life but struggles to maintain exceptional customer expectations and faces challenges to walk hand in hand with new features of customer service and innovation. However, the utility sector is getting a makeover with the rise in digitization and focus on customer-centric approaches.

Why CX has become talk of the town?

Earlier, the utility sector was not worried by competition due to limited choices available for the customers and as a result, CX was not a ‘big thing’. However, the amendment of policies, the advent of new technologies, and cut-throat competition have given new meanings to offering exceptional customer experiences. Today, CX is not just a feature but an imperative.

The Existing Scene

In the customer satisfaction surveys the the UK utilities sector consistently ranks below average. As per the latest UK Customer Satisfaction Index, the sector got 69.8 points.

The reasons for this considerably low point could be:

- Extended hold times

- Lack of transparency in billing

- No clear communication for outages

- Troublesome online management of accounts.

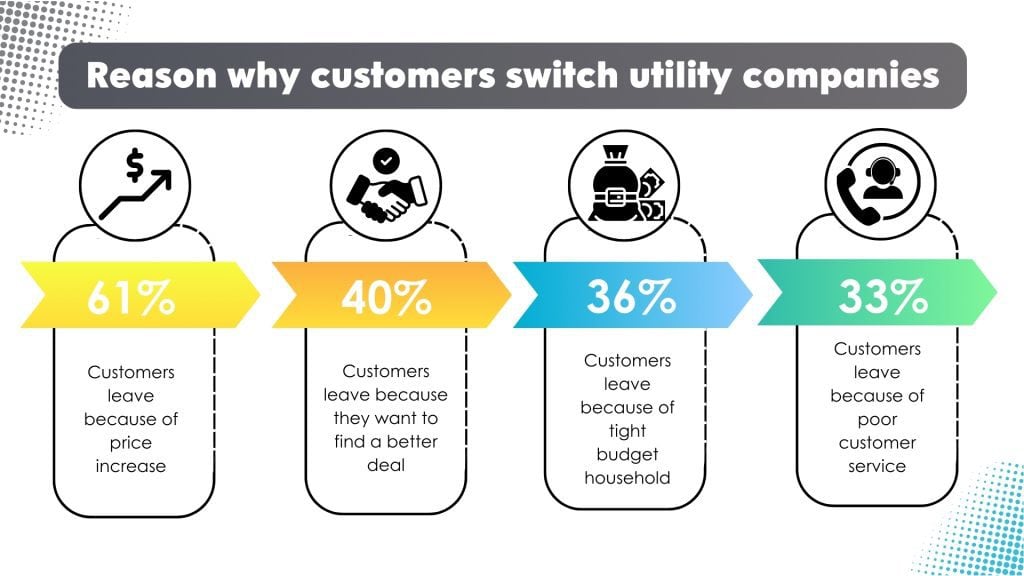

Like, mentioned earlier previously the customers didn’t have many choices and they kept attached to one company. However, now there is an adaptive transition. The entry of new companies in the market and regulatory changes have given way to healthy competition making customers the king and customer satisfaction a battle worth fighting for.

The effects of bad CX

Overlooking CX can have multifaced consequences:

- Customer Churn– Customers often leave a company and switch to another one when they encounter unclear bills, extended waiting time, and ineffective online set-up. A company’s revenue stream and market share are badly affected by Customer churn.

- Phone calls are not picked up, causing customers to hang up for, e.g. up to 50% of customers give up and hang up as calls are not answered.

- Destruction of brand’s name- Today’s market is heavily influenced by reviews and word of mouth. An anecdote of a bad experience can dissuade new customers and hamper the brand’s name.

- Operative Incompetence: Untrained and ineffective customer service progressions are generally unable to manage a large number of complaints pleasingly, and this leads to a rise in operational charges.

- Regulatory actions: Continuous customer issues and dissatisfaction incidents can also give rise to regulatory actions leading to penalties and compliance matters.

Enhancing Debt Recovery: CX Advancement in Utility

In utility companies, financial health can be maintained by implementing effective debt collection strategies. However, the relationship between companies and customers suffers a bolt during the collection of payment for the services. And the question here is how to maintain a balance between enhanced debt recovery and exceptional customer experience.

First-party or third-party collection entities handle the CX in the utility sector’s debt collection. It leads to upholding brand’s name, maintaining regulatory compliances, and fostering healthy customer relationships.

First-Party Collections

Obvious and certain disclosure:

What a customer appreciates most about a company is transparency. A clear picture of unpaid debts, payment options, and penalties related to non-payment provides peace of mind and gives the customer the option to manage the situation better.

Digital and electronic communication channels:

Digital communication channels provide two-way benefits it, promotes effective and convenient interactions, and also develop a customer-centric approach thus paving the way for effective debt recovery.

96% of utility businesses deploy over three communication methods: phone calls, email, social media, and messaging apps.

Responsiveness and Flexibility-

Empathy and responsiveness leave a long-lasting impact. The team should be well trained to keep an empathetic approach and provide support and flexibility as much as possible.

Simple accessibility-

It’s vital that debt collection is consumer friendly. The process of outstanding debt payment should be convenient and swift. The methods could mobile apps, payment platforms or customer care agents.

72% desired improved self-service and seamless access to some consumption data.

Third-Party Collections

Reliability and Compliance

Some of the vital features for upholding positive CX and evading legal breach are abiding by ethical practices and complying with applicable laws and regulations

Training and Oversight

Issues can be easily detected and resolved if regular monitoring and quality assurance are taken care of.

Resolution and Feedback Circle-

Customer feedback is one of the most efficient ways that can be embraced by Utility companies to identify improvement areas for debt collection efforts. Companies can take notes from the feedback and can implement the changes in debt management.

63% are more inclined to avail themselves of services for better offerings from several providers.

Installing technology

Artificial intelligence, machine learning, and data analytics play an essential role in striking a balance between customer-centric methods and convenient debt recovery practices. These technologies not only ease the whole process but also enhance CX, efficiency, and efficacy to a great level across the collection process.

73% of utility companies employ intelligent technologies like artificial intelligence to enhance software performance.

Advanced Strategies for Boosting CX in Debt Recovery

Insights-powered personalization-

- Companies can deploy data analytics to comprehend patterns in customers’ behavior regarding finances and payment.

- Customized debt collection strategies can be formed on the basis of each customer’s payment history and divided among the customers based on fulfilling individual requirements.

- Gentle reminders and payment plans suiting individual requirements can substantially enhance the rate of debt recovery and CX.

Assertive Reach outs- - Utility companies should contact customers via their chosen mode of communication, like SMS, email, or mobile apps, and send them payment and billing reminders and statements.

Adjustable payment plans

- In a world of tight budgets, installment plans and overdue payment options can be a boon for customers struggling with a pile of bills.

- Mobile applications and online payment platforms should enable easy access to accounts and payment methods.

Cooperative and friendly assistance

- It leads to instant positive outcomes when the agents come up with reasonable solutions rather than aggressive demands. Understanding customers’ situations and handling them empathetically leads to an enhanced CX.

- Assistance programs for financially struggling customers should be planned.

Deploying technology

- Optimization of collection through the deployment of artificial intelligence (AI) and machine learning.

- AI can anticipate customers’ behavior and can facilitate proactive interventions.

- Routine inquiries handled by chatbots can help agents focus on intricate issues.

Moving ahead:

Its high time that, UK utility companies should transform into a trusted partners from just being companies providing energy and water. This partnership will lead to enhanced CX and customer loyalty. consumer friendly debt recovery can proved to be a major differentiator for thriving in a competitive market. Both companies and customers can be part of a sunnier future when the utility sector will embrace a customer-centric debt collection approach.

We need to remember that we should not switch off the light focusing on CX while collecting payments for switching on the energy supply.